Retail media allows brands to advertise directly in spaces where consumers are already engaged. Retail media refers to ads placed within a retailer’s media network, where brands can purchase ad space to help consumers discover and learn more about their products during the shopping journey. Think of retail media as a “digital shelf,” similar to promotional displays and special offers in physical stores that increase brand visibility to shoppers.

–

What is a Retail Media Network (RMN)?

A Retail Media Network (RMN) refers to a platform where retailers open their own digital marketing channels—such as websites, mobile apps, in-store resources, and digital signage—for brands and advertisers to purchase advertising space. This allows brands to leverage retailers’ data and resources to enhance the effectiveness of their advertisements.

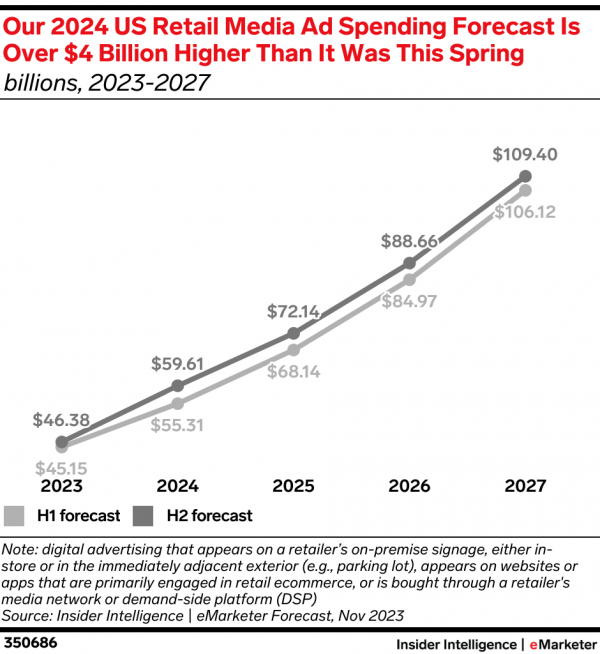

According to eMarketer, the global RMN market is projected to grow from $111.4 billion in 2023 to over $233.9 billion by 2027. In the U.S. alone, the market is expected to surpass $100 billion by 2027.

–

–

How does a Retail Media Network work?

Marketers can view a Retail Media Network as a new source of traffic, with a unique advantage of being closely aligned with consumers. Since all retail ads appear within the retailer’s online or offline channels, the audience reached through these ads often has a more genuine, immediate purchase intent.

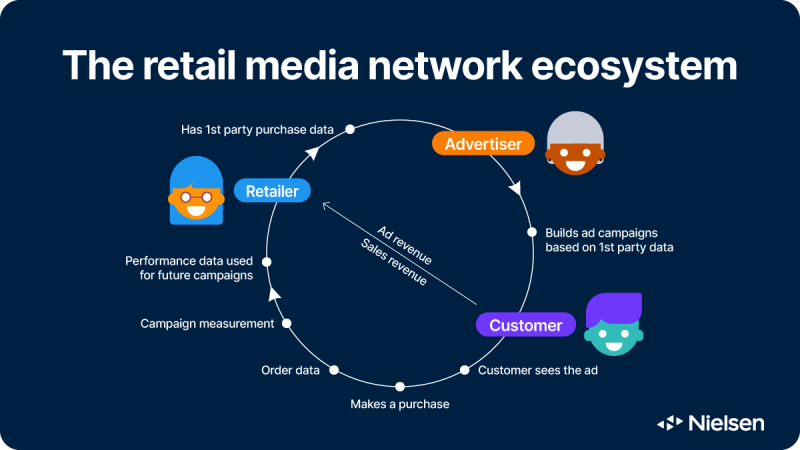

Essentially, retailers open up their digital advertising spaces – often referred to as “inventory” (and sometimes even off-site resources, if they are integrated) for brands to purchase ad placements. Brands can then leverage the retailer’s first-party data to target ads more effectively, influencing brand visibility and driving conversions. In simple terms, a Retail Media Network functions like in-store advertising across a retailer’s online and offline channels.

–

–

How are Retail Media ads displayed?

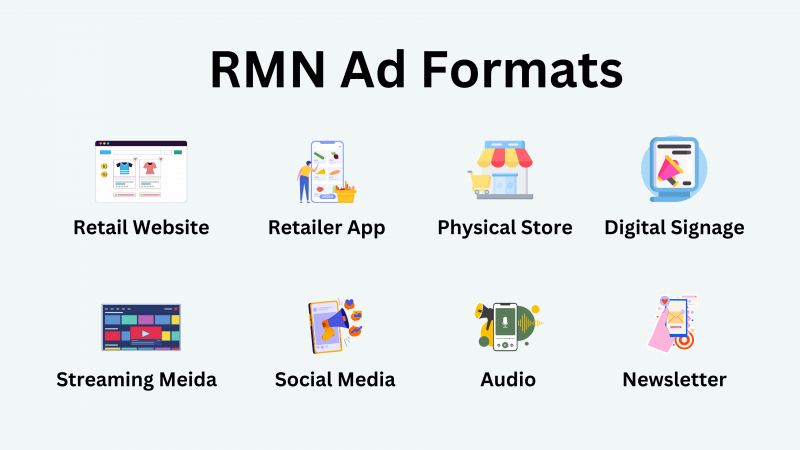

Retail Media Networks (RMNs) operate by utilizing retailers’ online and offline digital ad spaces, with ads delivered through automated platforms like DSPs. Using integrated retail data, RMNs help brands achieve visibility wherever consumers may be present. All ad performance metrics, consumer behavior, and data can be easily tracked and attributed.

In addition to traditional digital ads on websites, apps, and videos, RMNs offer unique advertising opportunities within physical retail stores. Digital ads can be displayed on in-store media, such as POS systems and digital signage, allowing brands to reach consumers at the closest point of sale.

––

The current state & outlook of Retail Media Network

In the current U.S. markets, numerous large retailers are competing in this new digital advertising space, with Amazon leading as the largest Retail Media Network, capturing 75% of RMN revenue in the U.S. Amazon provides a comprehensive RMN service, leveraging its vast ecosystem, which includes the world’s largest e-commerce platform, Amazon Prime Video streaming, Twitch game streaming, and physical grocery and retail stores to maximize the effectiveness of retail media advertising.

Walmart, with an RMN revenue of approximately $3.4 billion, ranks second in the U.S. RMN market. In addition to its strong e-commerce presence and extensive physical store network, Walmart has made strategic acquisitions, including purchasing smart TV brand Vizio for $2.3 billion, enabling it to serve ads on connected TVs in homes. Walmart has also announced a partnership with Disney to expand digital ad reach through streaming platforms Disney+ and Hulu. It’s clear that the key to RMN success lies in continuously expanding traffic channels and integrating various platforms through technology, allowing retail data, consumer behavior, and ad performance to be more easily attributed and impactful.

Source:AdAge

–

Why Retail Media is the 3rd wave of the advertising evolution: Retail data enables precision ad targeting

Retail media allows brands to advertise directly in spaces where consumers are already engaged. Retail media refers to ads placed within a retailer’s media network, where brands can purchase ad space to help consumers discover and learn more about their products during the shopping journey. Think of retail media as a “digital shelf,” similar to promotional displays and special offers in physical stores that increase brand visibility to shoppers.

Additionally, when brands advertise on a retailer’s website or app, these ads provide a more immersive experience for consumers when browsing product pages. As consumers interact with retail media or make purchases on these platforms, brands gain valuable consumer behavior insights, helping them better understand shopper patterns.

As the advertising industry evolves, access to first-party insights will only grow in importance for brands. Marketers will find that Retail Media Networks (RMNs) offer solutions for data-driven insights, enabling them to plan and make smarter media purchasing decisions more easily. This supports more strategic marketing campaigns. According to a 2021 study by eMarketer, the primary reason consumer packaged goods (CPG) brands choose to partner with RMNs is to gain access to first-party data insights.

–

The benefits of retail media for advertisers & brands

–

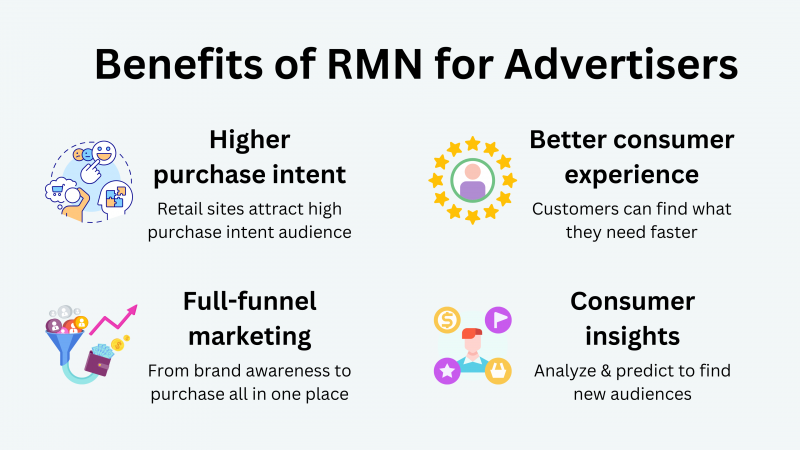

Retail Media Networks offer advantages for retailers, brands, and consumers alike. One reason RMNs are highly effective for brands and consumers is their ability to deliver ads that are highly relevant to their needs. Here are some specific benefits RMNs provide for brands:

1. Brands Can Reach Highly Relevant Consumers

One of the primary advantages of RMNs is their ability to help brands connect more effectively with highly relevant consumers. Shoppers visiting a retailer (online or offline) often have a strong intent to purchase, making brand ads on a retailer’s site more likely to capture consumer attention during their shopping journey.

RMNs also link ads to final conversions more clearly, allowing brands to track the entire journey from ad exposure to purchase. This insight helps brands analyze the connection between ad spend and product sales, informing more strategic decisions, such as adjusting inventory levels, optimizing resource allocation, or refining ad budgets.

2.Customers Can Discover the Products They Need

When consumers browse specific products on a retailer’s site, they may see brand-sponsored ads related to what they’re looking for. This can help consumers discover new brands more directly and increases the likelihood of trying out new products.

Given that these consumers often have a high intent to purchase, highly relevant promotional content, new product launches, or special offers integrated into the shopping journey feel more natural and less intrusive. This can significantly enhance the likelihood of a purchase, as the ads blend seamlessly into the consumer’s buying experience.

3. Full-Funnel Marketing Strategies on Retailer Sites

Since consumers visiting a retailer’s site typically have a high intent to purchase, and because first-party data allows for precise tracking and attribution, full-funnel marketing strategies are easier to execute. Every stage of the customer journey—from the first visit to the retailer’s site, adding items to the cart, browsing different product pages, completing a purchase, and even making repeat purchases—occurs within a closed loop environment, providing advertisers with comprehensive analysis.

Brands and advertisers can segment audiences based on data and deliver tailored ads and promotions for each stage, significantly boosting awareness, conversion rates, and overall performance.

4. Expanding customer base to reach new audiences

By analyzing first-party data, advertisers can target their core audiences more accurately and also identify opportunities to engage other potential customers. For example, a brand specializing in frozen dumplings could get a better look into whether consumers interested in dumplings might also show interest in other frozen foods. The brand could then have targeted ads for new dumpling products to frequent frozen-food shoppers, offering first-time discounts or other promotions. This strategy not only increases dumpling sales but also expands the brand’s customer base by reaching new audiences.

–

The benefits of retail media for retailers?

Retailers play a crucial role in the Retail Media Network ecosystem. Beyond providing retail traffic and a variety of ad placements (inventory), the most valuable asset they have is their first-party data. Because consumers visiting a retailer’s website, app, or physical stores typically have a higher intent to purchase compared to visitors on other media (i.e. content sites), the consumer behavior data collected in these environments is more accurate and impactful across the entire customer journey.

For retailers, joining an RMN primarily allows them to create a new revenue stream. By expanding beyond traditional retail sales, they can develop an advertising business and generate revenue by selling ads. Of course, user experience remains the top priority. Key players in building RMNs, including technology providers and retailers themselves, must ensure that ads are relevant to consumer needs. If the ad experience is poorly managed, it not only wastes premium ad space and advertisers’ marketing budgets but also risks driving consumers away, leading them to consider alternative retailers.

–

The value of retail data for advertisers

The power of first party data

In today’s advertising environment, first-party data offers unparalleled advantages, enabling in-depth insights into customer preferences and behaviors for precise targeting, accurate measurement, and effective attribution. In the past, brands largely relied on cookies and third-party data. However, with privacy regulations and policy changes, everyone must seek sustainable ways to ensure effective marketing.

First-party data provides a more transparent and direct approach, especially within the RMN context, allowing advertisers to utilize the datasets either directly or through trusted RMN partners for targeted advertising. Throughout and after the online shopping journey, brands can continuously engage consumers with relevant product ads, boosting revenue and conversion rates.

–

The exchange & flow of retail data

However, an essential distinction to consider is that retailers’ first-party data must flow seamlessly between online and offline channels to optimize results. Emerging solutions to this challenge include Customer Data Platform (CDP) and Data Clean Room (DCR). As the digital landscape evolves, advertisers and retailers will inevitably work with multiple DCRs, which presents challenges in scalability and security. A robust CDP will help brands play a critical role in managing their first-party data and facilitate easier collaboration with DCRs, ensuring data is used securely and efficiently. This approach not only simplifies data collaboration but also significantly enhances data-driven decision-making capabilities, providing a comprehensive view of the customer journey.

–

What is Data Clean Room (DCR)?

–

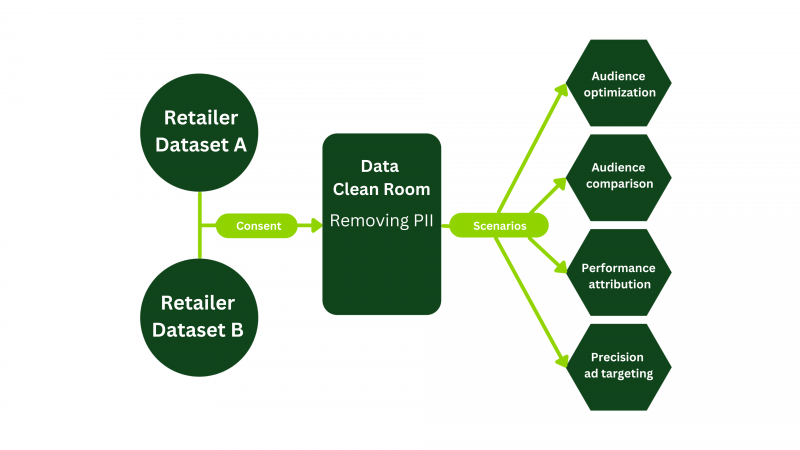

The core concept of Data Clean Room is to address the impending deprecation of third-party cookies, providing a new way for advertisers to use data. Due to strict privacy regulations, data owners cannot freely use sensitive personal information (e.g., phone numbers, email addresses) for commercial purposes. DCRs offer a way to exchange data securely. Below is an overview of how data enters and interacts with a DCR:

- Data from the retailer or DSP platform is uploaded to the DCR.

- The DCR facilitates data exchange between both parties (or multiple parties).

- The DCR removes any personally identifiable information (PII) before exporting, enabling DSP platforms to use the retailer’s data for advertising.

Several major companies are already promoting DCR services, primarily to support the shift from cookies to first-party data. However, privacy policies and the concerns from brands who own data become a driving force behind the market gradually adopting DCR as a solution.

–

What is a Customer Data Platform (CDP)?

Customer Data Platform (CDP) primarily addresses data storage, integration, and insight analysis. CDP is especially useful for brands with extensive consumer data. CDPs help consolidate data from various sources (e.g., websites, membership apps, offline POS, social media) and provide a unified perspective to support business and marketing decisions. Managing customer data with a CDP has numerous applications, including:

- Understanding customer preferences, behaviors, and purchase history to predict future needs.

- Helping brands plan more personalized products and services.

- Enhancing the relationship between brands and customers.

- Leveraging data insights for market analysis and forecasting, enabling brands to make informed business decisions.

The main difference between a CDP and a DMP (Data Management Platform) is that a DMP primarily collects anonymous data, handling third-party data mostly for ad targeting. In contrast, a CDP focuses on managing a brand’s first-party data. As cookies phase out, first-party data will become essential, fostering a tighter ecosystem among brands, advertising platforms, retailers, and data-ready websites, all working together to integrate data across platforms.

–

How to improve marketing performance using retail data insights?

When developing marketing strategies and optimizing campaigns, brands and advertisers typically rely on historical data for guidance. Effective outcomes usually require continuous data analysis for improvement. Using an RMN offers added value beyond conversion, such as:

- More precise targeting: Brands can use first-party data to better understand consumer behavior, implementing advanced segmentation strategies to reach consumers with different profiles, such as “purchased three times in the past month,” “average order value above a certain amount in the last three months,” or “purchased before but hasn’t returned in a month.”

- More consumer insights: Brands can better predict future behavior trends and identify cross-selling and upselling opportunities by analyzing actual consumer behavior and purchase data.

- Effective campaign performance checks: Traditional ad performance metrics may not fully capture results, especially when it’s tied to sales, making attribution ever more challenging. However, RMN with its closed loop nature, offers brands the ability to track the entire customer journey and purchase behavior and pinpoint the exact areas where the campaign falls short.

- Product and service optimization: Even FMCG brands selling within retail environments need ongoing consumer feedback to get a sense of how satisfied consumers are with their products and services. Retail data, along with sales records, can reflect the market’s view of the products or services. Though many factors affect product sales, there are areas for improvement in the retail setting, such as product placement, ad placement, content design, and alignment of product strategy with the retail channel.

- Enhancing customer loyalty: First-party consumer data allows brands to communicate better with loyal customers. For instance, they can design personalized promotions for each demographic, such as offering more discounts to price-sensitive groups or recommending relevant products to those who shop less frequently but spend significantly more with higher shopping cart value.

–

Key technologies & Adtech for building an RMN ecosystem

Demand-Side Platform (DSP)

A DSP (Demand-Side Platform) assists advertisers in finding the right media traffic for ad placements. Its primary function is to aggregate different media traffic, support different ad formats (e.g., video, display, app), and offer campaign optimization tools. Traditionally, DSPs are connected to media traffic sources like Facebook, Google, and various publishers. Retail media traffic differs significantly as it features high purchase intent consumers and consumer behavior analytics with first-party data. A DSP that connects multiple retailers will allow brands to filter audiences and industries based on criteria and place ads across multiple RMNs, maximizing data value. Future-ready RMN DSPs should have:

- AI and data-driven capabilities: Beyond cross-media advertising, DSPs must ensure accuracy by integrating retailers’ first-party data, third-party data from ad tech platforms, and audience profiles, with 24/7 analysis and optimization.

- Cross-media advertising: They must link multiple retailers and unify online and offline ad placements, allowing brands to target based on audience, brand association, and industry requirements.

- Automated traffic control: Automatically selects traffic best suited to the brand’s needs based on campaign performance, using criteria such as audience, brand characteristics, industry preferences, and consumer profiles.

- Seamless integration with DMPs: In RMNs, DMPs handle data from multiple retailers, turning it into actionable audience segments, which is key to RMN success.

–

Real-time Bidding (RTB)

DSPs calculate the potential effectiveness of ad placements for different audiences and bid for each impression opportunity. Websites use RTB to sell each impression to the highest bidder.

When a DSP wins an impression, it delivers the ad to a specific audience. Consumers see ads that interest them, advertisers avoid wasting budget on ineffective impressions, and websites sell impressions at the highest price, resulting in a win-win situation between advertisers and publishers.

–

Data Management Platform (DMP)

A DMP combines 1/2/3rd party data to analyze consumer behaviors, purchase records, browsing patterns and build consumer profiles and audience segments. The data can help brands identify optimal target audiences. In retail media advertising, DMPs provide insights that support more precise ad placement and enable brands to make better business and marketing decisions. Significant technical advancements are still needed to achieve the goal of cross-retail advertisement by integrating online and offline retail data across different retailers.

–