Depending on the organization’s needs, there are various types of retail media services available in the market. Even niche channels with modest traffic can provide unique value from a data perspective. As retail media expands in Taiwan, more options and applications will emerge, allowing retailers to collaborate with partners for technical and ad sales support, while advertisers will have more data and traffic options—creating a win-win situation for overall market growth.

–

Retail Media: Growth Opportunities Everyone in the Industry Should Know

If you’re curious about retail media, this article will help you understand how to effectively invest in retail media and leverage these resources to drive business growth. Even if you already have an initial plan, this article can provide further insights to help you gain more influence and grow your brand in the future retail media market.

–

Where Are the Growth Opportunities for Retailers (Media Suppliers)?

Main Monetization Methods for Retail Media

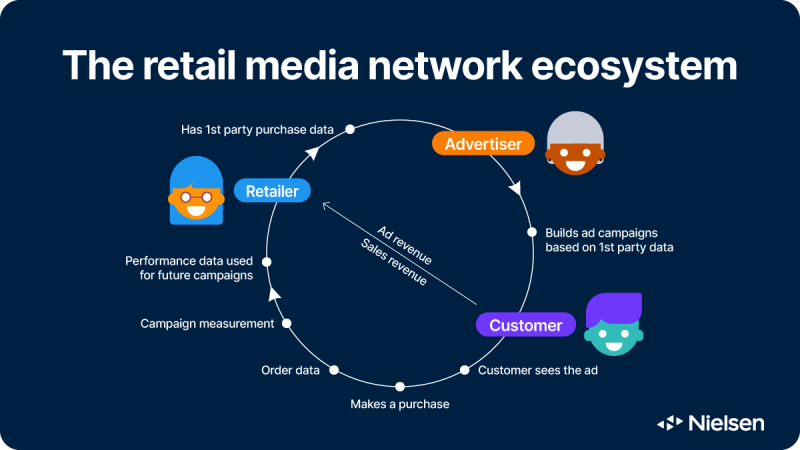

With the trend of digitalization and online-merge-offline (OMO), more and more retailers and marketplace platforms are using their resources to monetize through advertising, including physical stores, first-party data, and their membership bases. Even in Europe and the United States, the retail media network (RMN) market is dominated by a few key players, such as Amazon and Walmart. In Taiwan, some retailers have begun transforming retail resources into marketing and advertising assets, like using digital out-of-home (DOOH) displays in physical stores, leveraging POS systems at checkout, or running marketing campaigns through branded apps to drive consumers back to physical stores. These initiatives depend heavily on the integration of retailer data and traffic inventory.

Retailers of different scales can find success in retail media, with expansion strategies varying based on their unique approaches.

Large Retailers

Take Amazon and Walmart in the United States as examples. These retail giants invested heavily in retail media early in its development and have seen significant growth. According to Walmart’s FY25 Q2 financial report, its retail media business, Walmart Connect, grew by 30% year-on-year. Large retailers have the resources to create their own platforms and build in-house teams, adopting a direct sales model that attracts advertisers without the need for profit sharing.

Such retailers are equipped with sufficient capital and technological capabilities to establish comprehensive technical, sales, and operational processes. This provides them with high levels of control and substantial profit margins but also means they need to take on significant initial investment.

Small to Medium-Sized Retailers

For retailers lacking significant capital and technical resources, media advertising sales and management may not be a core competency, and many companies avoid heavy investments. These retailers typically set up dedicated departments and collaborate with third-party partners to develop retail media solutions.

To achieve profitability in retail media, the key lies in technology integration (e.g., ad placement), media sales (which requires a sales team), and data handling and analysis (continually providing valuable data to advertisers). Retailers often have high-value first-party data, but to maximize its value, effective integration of technology, ad placement, and media sales is crucial. For most small to medium-sized retailers, partnering with a provider that offers a comprehensive tech solution and ad sales support is the most sensible choice.

–

–

Different Retail Media Implementation and Operation Models

Independent Network Model

Retailers develop and maintain retail media operations in-house, covering aspects like building technology platforms, media sales, data reporting, and analytics, all managed by dedicated teams. Though resource-intensive, this model allows retailers to fully control retail media development and operations, making it a strategic model for well-resourced large retailers.

Lightweight Independent Network Model

Retailers can collaborate with third parties and adopt a white-label approach, where the third party provides the platform technology, while the retailer sells services under its brand, managing ad sales and operations internally. This approach saves resources and maintains brand independence without having to start from scratch.

Hybrid Model

This model involves outsourcing the development and operation of the technology platform while the retailer focuses on ad sales and customer service. This is a convenient option for retailers with existing ad sales teams, enabling them to enter the retail media space without significant internal restructuring.

Outsourcing Model

In this model, retailers rely entirely on APIs or media integration partners for technology and content, without developing their own platforms. This simplifies technology requirements and operating costs and is suitable for resource-limited retailers.

Challenges for Retailers Entering Retail Media

- Building the platform can be costly, and advertising operations are complex for traditional retailers.

- A complete tech, operations, and service team is needed.

- Internal resource allocation and struggles may determine whether retail media can be sustainably developed.

–

Considerations for Scaling and Profitability in Retail Media

1. Managing Retail Media Business

Most retailers face bottlenecks in infrastructure and human resources while developing a retail media network (RMN). Planning operational and management strategies ahead of time is crucial to scaling an RMN effectively.

Breaking Down Silos

To expand an RMN, your team must operate like a media company, integrating workflows, cross-department communication, shared KPIs, unified market strategies, and a clear product and service roadmap. This means that business, operations, technology, and product teams need to work collaboratively, and a senior executive should oversee the project to ensure alignment and facilitate internal and external communications.

Prepare Internal Proposals

Since retail media is still relatively new in Taiwan, expanding RMN initiatives will undoubtedly require company support, especially from the customer experience and product teams, who may be concerned about how ads will impact existing customers and partners.

- Retail media is not just a way to boost revenue; if developed steadily, it can benefit the overall company.

- The revenue from retail media is incremental and tends to be higher-margin compared to other product sales.

- Retail media is highly personalized and contextually relevant, improving the consumer experience and helping shoppers quickly find what they need.

–

2. Diversifying Advertising Demand Sources

Not all retailers have end-to-end ad sales capabilities, and relying solely on internal resources may not be the best strategy. To maximize ad revenue, you need to develop both direct sales (internal teams finding advertisers) and indirect sales (through ad agencies). This provides the best balance between revenue growth and operational efficiency.

One quick way to expand is by partnering with DSP platforms. Once connected, advertisers on the DSP can place ads on your retail media.

We also recommend avoiding a closed-off retail media strategy or limiting it to a few existing customers. If you’re working with ad agencies, they’re interested in ease of retail media operation. If you or your platform offers self-serve capabilities, it presents opportunities to expand your retail media through various channels.

RMN Planning Suggestion: Look for promising brands. Many retailers focus on finding niche brands that can meet specific needs to develop retail media.

–

3. Expanding Advertising Product Options

While sponsored ads are the main source of retail media revenue, advertisers have varied needs. We recommend developing upper- and mid-funnel advertising products, combining retail media’s consumer intent characteristics to help brands create diverse consumer experiences.

- Develop upper and mid-funnel onsite and offsite ads that influence brand exposure and consumer decisions throughout the shopping journey.

- Enhance the full media experience by integrating physical stores and social channels, ensuring consistent brand messaging.

- Rich video ad formats can effectively help brands reach and engage shallow-funnel consumers.

–

–

4. Leveraging Partner Expertise

If you’re planning to collaborate with external partners for ad sales and operations, fully utilize their expertise and execution capabilities, which are often invaluable during your retail media expansion. Key services include:

- Ad Services: Planning overall advertising campaigns, promotional programs, and phased execution.

- Data Analysis: Compiling data insights and reports to create actionable plans for internal discussions.

–

5. Mitigating Risks and Resource Strain

Expanding RMN is not just about increasing ad revenue but also involves organizational, technical, and operational challenges that grow along with the business.

Potential Bottlenecks

If initial retail media revenue falls short, will your organization continue to support your growth strategy? If not, how will you build the necessary capabilities?

Many companies are wary of profit-sharing models, but these may be the most efficient and profitable growth paths. Partnering with experienced third parties can ease your burden and help you enter the market quickly. Profit-sharing agreements, including splits and contract terms, need careful consideration.

Building your own platform isn’t always the only solution; profit is key.

Not every retailer needs a complete RMN. In some cases, simply selling retail media ads can yield good returns without the risks associated with building a platform and full services. This lets you focus on product sales, enhancing the shopping experience, membership engagement, and product assortment—turning your online or offline retail points into attractive venues for advertisers while securing a decent profit.

–

Optimizing Ad ROI for Advertisers

Retail media has already proven its growth potential and value, presenting new opportunities for advertisers. The most immediate advantage is brand safety and high consumer intent, leading more advertisers to invest in boosting their influence.

According to a McKinsey survey, 70% of U.S. advertisers believe retail media outperforms other media, and 80% think retail media is as important as social and mobile ads in today’s ad landscape.

How Do Advertisers Buy Retail Media?

Advertisers have many ways to buy retail media. They can choose to partner with ad agencies, integrated marketing companies, SaaS advertising platforms, or RMN technology and solution providers, depending on their chosen strategy.

Advantages of External Partners

Working with external partners grants advertisers instant access to advertising expertise, retail media insights, and strategic guidance. Collaborating with agencies can encompass RMN operations, data analysis, and integration with other media channels for a holistic advertising approach.

Campaign Flexibility

Advertisers investing in specific retail media—whether a particular industry or a large RMN—can look for suppliers that provide comprehensive services, ensuring campaign management and marketing strategy execution. If an advertiser already has an ad operations team, self-serve platforms can offer greater control over planning, execution, and optimization.

Reasons Advertisers Avoid Retail Media

- Too many marketing tools and platforms to manage already.

- Additional advertising tech team support may be required.

- Lack of unified standards across media channels makes attribution and performance evaluation difficult.

–

Five Things Advertisers Should Consider to Improve Retail Media Performance

1. Avoid Over-Reliance on Specific Media

While mainstream media technologies are well-developed, they may not always offer the best ROAS due to high costs. When market dominance leads to less competition, there may be fewer incentives to provide better services.

We suggest exploring diverse retail media platforms and services beyond mainstream media, finding what works best. Not being overly dependent on one or two platforms allows new media to emerge and ultimately benefits advertisers.

Using Mid- to Long-Tail Strategies to Seize Opportunities

Retail media’s unique advantage lies in its potentially lower costs and high brand affinity, making it an excellent choice for promoting emerging or new products. While investing in mainstream media is a safe choice, retail media offers a new growth avenue on the retailer’s battlefield.

–

2. Strategically Increasing Investment in Retail Media

Brands that spend more on retail media tend to perform better in retail channels. However, given the potential opportunities, current spending on retail media remains relatively low. Retail media offers insights into consumer behavior, which can only be gained through sustained investment, allowing for continuous monitoring of your brand’s performance on retail media.

We recommend allocating a portion of your media budget to retail media. For consumer brands, strategically spreading your budget across different retail media helps reach audiences you otherwise wouldn’t connect with.

–

3. Adopting a Full-Funnel Approach to Marketing

A comprehensive understanding of media characteristics to achieve brand growth is always a sound strategy, especially during sales peaks like New Year, Ghost Festival, Mid-Autumn Festival, and Double 11. Given retail media’s closed-loop nature, it offers better, more intuitive tracking of the consumer journey, from ad exposure to shopping cart to purchase.

For new and existing customers, creatively using different ad formats, such as video and display ads, helps build strong connections, and placing ads across key pages like the homepage, product categories, and checkout page enhances effectiveness.

–

4. Maximizing Data Value with Always-On Ads

Retail media’s unique value lies in its ability to draw consumer profiles from behavior data. However, this requires continuous investment from advertisers. Consistent data yields better results compared to sporadic campaigns, allowing for deeper and more objective insights into consumer behavior.

We suggest keeping ads on retail media year-round—not necessarily with a big budget every month—adjusting resources flexibly for annual plans, promotions, and even unexpected events like typhoons. By accumulating behavioral data on brand audiences, you’ll achieve more cost-effective results during peak periods, rather than relying on large, one-time ad investments.

More data also enables better AI and machine learning applications, providing long-term benefits and more reliable consumer insights. This ultimately contributes to a comprehensive impact on the audience’s shopping journey, helping brands build an irreplaceable advantage and loyalty.

–

5. Simplify Operations and Reduce Complexity

Many organizations already manage numerous platforms and tools, adding more can become a burden. When expanding into retail media, consider the impact on your team. We suggest working with fewer retail media partners to streamline management.

Choosing a supplier or platform that offers all necessary services allows greater flexibility and resources to handle unexpected situations when developing retail media.

How Can Retail Media Partners Help?

- Open advertising platforms allow advertisers to buy retail media across multiple channels.

- Transparent retail media inventory management.

- Precise ad targeting based on retailer data.

- A variety of ad formats. Complete reports, conversion attribution, and insightful analysis.

- CPM and CPC pricing options.

–

Finding the Right Retail Media for You

Retail media is developing rapidly, and both retailers and advertisers have opportunities to find their own profitable models through this new type of media.

With various retail media services available, even niche channels with modest traffic can offer unique value. As retail media expands in Taiwan, more options and applications will emerge, enabling retailers to find partners to handle tech and ad sales while giving advertisers more data and traffic options—a win-win for the overall market.

Each organization has different goals, resources, and development stages; finding the most suitable retail media to help your organization grow is the most important task.