Retailers who fail to recognize this critical shift risk losing out on brands’ advertising budgets. As eMarketer analyst Andrew Lipsman noted: “If retailers want to capture more media spend, they must shift away from a traditional retailer mindset and adopt practices akin to those of advertising media companies.”

Brand-Centric Retail Media Strategies

For retailers investing in Retail Media Networks (RMNs), two things are certain:

- Entering the retail media market is a smart decision. According to forecasts, spending in the retail media sector will continue to grow at double-digit rates through 2025.

- As competition intensifies, retailers must enhance their investments and identify their unique advantages in an increasingly crowded marketplace.

It is widely recognized that retail media is growing at an astonishing pace, and the baseline requirements for RMNs are constantly evolving. According to the Mars Agency’s Q3 2023 Retail Media Report, out of 65 evaluation criteria, as many as 44 are now considered fundamental requirements for RMNs. Establishing a Retail Media Network is already a challenging endeavor, and the rapid pace of market changes means that retailers who slow down at this moment risk missing out on this new growth opportunity.

The Evolving Relationship Between Retailers and Brands

–

The driving force behind retailers needing to keep up with market developments comes from brands. This shift necessitates a new way of thinking: brands are no longer just partners—they are the customers themselves.

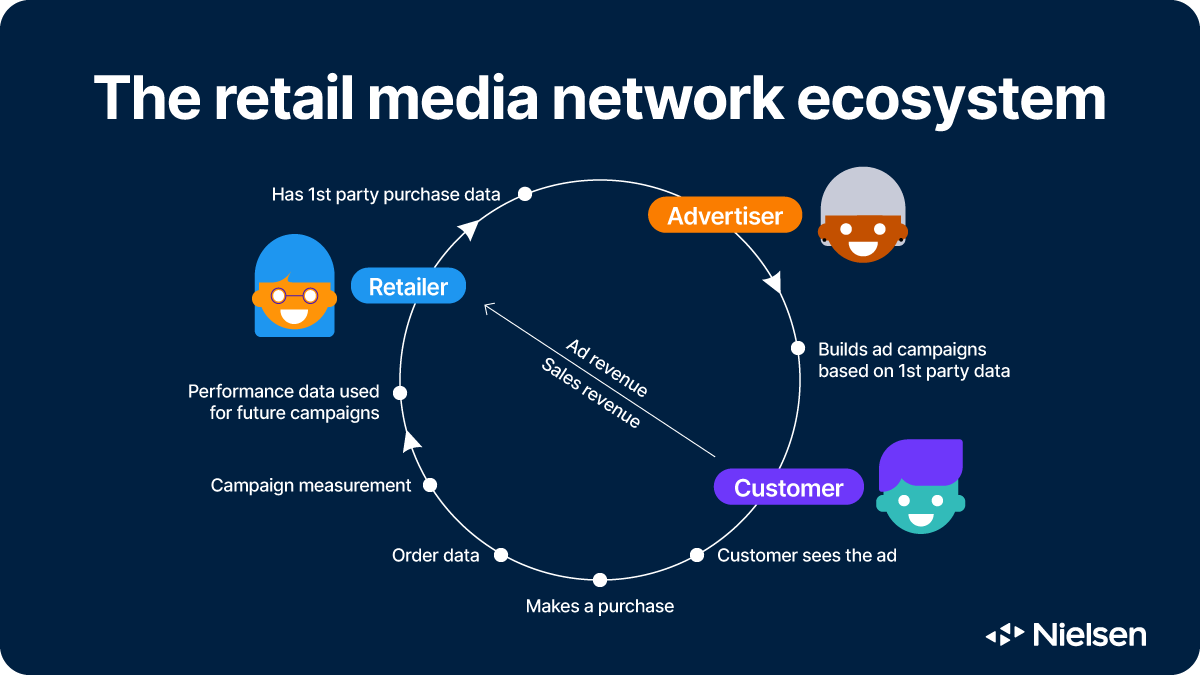

Before the emergence of retail media, the collaboration between retailers and brands was largely one-directional. Brands often had to find ways to win retailer support, positioning retailers as their “customers.” Now, as more retailers transform into media companies or seek to generate advertising revenue, brands have become the customers of their advertising products. This role reversal has fundamentally altered the dynamic: retailers are now both the customers of brands and the suppliers of their advertising and data solutions.

Retailers who fail to recognize this critical shift risk losing out on brands’ advertising budgets. As eMarketer analyst Andrew Lipsman noted: “If retailers want to capture more media spend, they must shift away from a traditional retailer mindset and adopt practices akin to those of advertising media companies.”

For retailers accustomed to focusing on traffic and sales performance, this means adopting a new perspective—thinking from the brand’s point of view. Ultimately, the retail platforms and RMNs that can best meet brand needs will be the ones to attract the most brand investments.

Embracing a Brand-Centric Mindset

Adopting a strategy of “fully supporting brands to achieve their advertising goals, no matter what they need” may make some retailers uneasy, particularly when it comes to sharing control over consumer data and audience insights. However, a study by Forrester Consulting reveals that 82% of commerce media decision-makers in retail or travel industries believe that an efficient advertising network has a significant or transformative impact on revenue and profit margins. This highlights that a brand-centric approach is the right path forward.

What Makes Advertising “Efficient” in the Eyes of Brands?

According to research by Merkle, brands identify the following as the two most critical factors for effective retail media:

- A seamless and straightforward collaboration experience with retail platforms.

- The ability to work with partners who understand their business and can co-develop marketing strategies.

Offering a diversified range of services and striving to become a strategic partner for brands are key to attracting brand advertising budgets. Brands are accustomed to the streamlined processes and professional services of traditional media buying. Retailers who can meet these expectations are more likely to become the preferred partners for brand advertisers.

From mindset shifts to practical implementation

Once retailers embrace the mindset shift required by this new model, they can overcome the most significant challenges. The next step involves concrete actions to meet brand needs, including adjusting internal processes, forming new advertising teams, and collaborating with technology partners to provide the necessary tools, such as self-service advertising platforms or advanced data insight reports.

Balancing partner needs while protecting the interests of their platform is an art. Retailers who actively listen to brand needs with an open mind and innovate to support brand goals will undoubtedly become the top choice for advertisers allocating their media budgets.

The flywheel effect of retail media: integrating onsite and offsite advertising

In the era of digital marketing and outcome-driven campaigns, many marketers are strengthening their data strategies. Beyond ensuring privacy and secure data usage, the primary objective is to leverage data to deliver more precise and impactful brand influence. Retail media has emerged as a leader in this area.

At the same time, brand advertisers face immense market pressure to enhance brand awareness and drive tangible business outcomes. Retail media has become a key focus for their exploration, with advertisers ready to allocate more media budgets to this channel.

The demand for retail media is skyrocketing, with no signs of slowing down. However, retail media inventory is inherently limited, and product ads alone cannot satisfy the growing budgets of brands and agencies. So, how can retailers harness this momentum and uncover new growth opportunities? One answer lies in Offsite Retail Media.